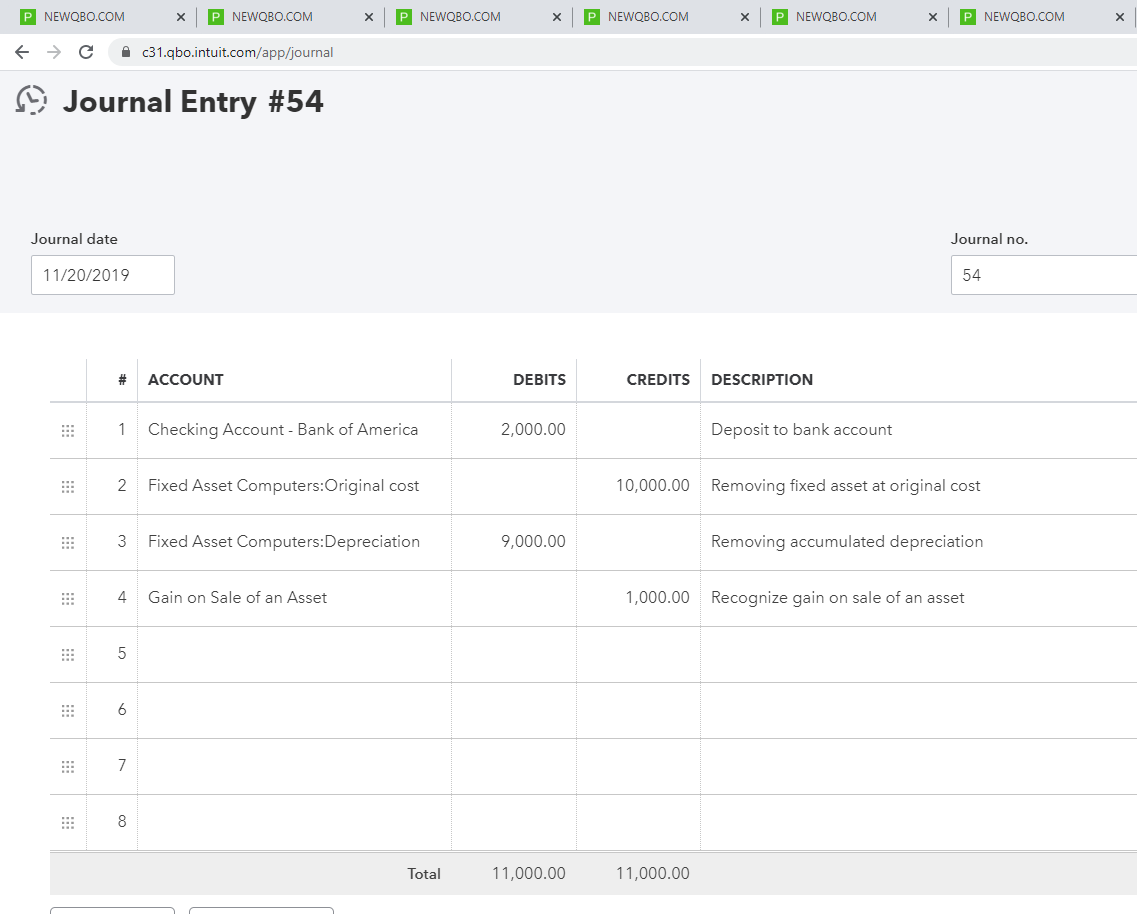

How To Record A Loss On Sale Of Asset In Quickbooks . When an asset is sold for less. Determine the selling price of the asset. We sell the truck for $15,000. i need to record gain on sale of a property. recording the sale of an asset is not at all straightforward from an accounting and tax perspective. Then it depends, if the. I don't see gain/loss on sale of asset as a choice under income or other. Create an income account called gain/loss on asset sales. The first step in recording the sale of an asset in quickbooks. in that scenario, you may sell it with no gain or loss, or you may sell it which. journal entry for loss on sale of fixed assets is shown on the debit side of profit and loss account. journal entry showing how to record a gain or loss on sale of an asset. october 15, 2018 06:21 pm.

from newqbo.com

We sell the truck for $15,000. i need to record gain on sale of a property. journal entry for loss on sale of fixed assets is shown on the debit side of profit and loss account. Then it depends, if the. When an asset is sold for less. october 15, 2018 06:21 pm. Create an income account called gain/loss on asset sales. recording the sale of an asset is not at all straightforward from an accounting and tax perspective. Determine the selling price of the asset. The first step in recording the sale of an asset in quickbooks.

How do I record fullyowned fixed asset equipment that has been sold

How To Record A Loss On Sale Of Asset In Quickbooks When an asset is sold for less. Create an income account called gain/loss on asset sales. journal entry for loss on sale of fixed assets is shown on the debit side of profit and loss account. Then it depends, if the. recording the sale of an asset is not at all straightforward from an accounting and tax perspective. I don't see gain/loss on sale of asset as a choice under income or other. october 15, 2018 06:21 pm. Determine the selling price of the asset. in that scenario, you may sell it with no gain or loss, or you may sell it which. We sell the truck for $15,000. The first step in recording the sale of an asset in quickbooks. When an asset is sold for less. journal entry showing how to record a gain or loss on sale of an asset. i need to record gain on sale of a property.

From quickbooks.intuit.com

Use Fixed Asset Manager in QuickBooks Desktop How To Record A Loss On Sale Of Asset In Quickbooks Create an income account called gain/loss on asset sales. Determine the selling price of the asset. journal entry showing how to record a gain or loss on sale of an asset. october 15, 2018 06:21 pm. in that scenario, you may sell it with no gain or loss, or you may sell it which. We sell the. How To Record A Loss On Sale Of Asset In Quickbooks.

From scribehow.com

how to record a fixed asset purchase in quickbooks online Scribe How To Record A Loss On Sale Of Asset In Quickbooks october 15, 2018 06:21 pm. i need to record gain on sale of a property. Create an income account called gain/loss on asset sales. recording the sale of an asset is not at all straightforward from an accounting and tax perspective. journal entry showing how to record a gain or loss on sale of an asset.. How To Record A Loss On Sale Of Asset In Quickbooks.

From exoeixsha.blob.core.windows.net

How To Record The Sale Of An Asset In Quickbooks at Anna Floyd blog How To Record A Loss On Sale Of Asset In Quickbooks i need to record gain on sale of a property. The first step in recording the sale of an asset in quickbooks. journal entry for loss on sale of fixed assets is shown on the debit side of profit and loss account. Then it depends, if the. Determine the selling price of the asset. october 15, 2018. How To Record A Loss On Sale Of Asset In Quickbooks.

From quickbooks.intuit.com

statement guide Definitions, examples, uses, & more QuickBooks How To Record A Loss On Sale Of Asset In Quickbooks Determine the selling price of the asset. Create an income account called gain/loss on asset sales. journal entry for loss on sale of fixed assets is shown on the debit side of profit and loss account. Then it depends, if the. We sell the truck for $15,000. When an asset is sold for less. october 15, 2018 06:21. How To Record A Loss On Sale Of Asset In Quickbooks.

From hevodata.com

Setting Up Profit and Loss Statement in QuickBooks 6 Easy Steps How To Record A Loss On Sale Of Asset In Quickbooks I don't see gain/loss on sale of asset as a choice under income or other. in that scenario, you may sell it with no gain or loss, or you may sell it which. The first step in recording the sale of an asset in quickbooks. i need to record gain on sale of a property. We sell the. How To Record A Loss On Sale Of Asset In Quickbooks.

From evergreensmallbusiness.com

QuickBooks Fixed Asset Items A Quick Tutorial How To Record A Loss On Sale Of Asset In Quickbooks I don't see gain/loss on sale of asset as a choice under income or other. october 15, 2018 06:21 pm. The first step in recording the sale of an asset in quickbooks. journal entry showing how to record a gain or loss on sale of an asset. i need to record gain on sale of a property.. How To Record A Loss On Sale Of Asset In Quickbooks.

From www.outputbooks.com

Record Profit/Loss on the sale of fixed assets Output Books How To Record A Loss On Sale Of Asset In Quickbooks i need to record gain on sale of a property. When an asset is sold for less. Create an income account called gain/loss on asset sales. The first step in recording the sale of an asset in quickbooks. I don't see gain/loss on sale of asset as a choice under income or other. Then it depends, if the. . How To Record A Loss On Sale Of Asset In Quickbooks.

From newqbo.com

How do I record fullyowned fixed asset equipment that has been sold How To Record A Loss On Sale Of Asset In Quickbooks october 15, 2018 06:21 pm. When an asset is sold for less. in that scenario, you may sell it with no gain or loss, or you may sell it which. journal entry showing how to record a gain or loss on sale of an asset. recording the sale of an asset is not at all straightforward. How To Record A Loss On Sale Of Asset In Quickbooks.

From deximal.ca

How to Read Your QuickBooks Online Profit & Loss Report Deximal How To Record A Loss On Sale Of Asset In Quickbooks The first step in recording the sale of an asset in quickbooks. Create an income account called gain/loss on asset sales. When an asset is sold for less. journal entry for loss on sale of fixed assets is shown on the debit side of profit and loss account. I don't see gain/loss on sale of asset as a choice. How To Record A Loss On Sale Of Asset In Quickbooks.

From www.youtube.com

How To Record The Sale Of A Fixed Asset In QuickBooks Online QBO How To Record A Loss On Sale Of Asset In Quickbooks in that scenario, you may sell it with no gain or loss, or you may sell it which. i need to record gain on sale of a property. The first step in recording the sale of an asset in quickbooks. recording the sale of an asset is not at all straightforward from an accounting and tax perspective.. How To Record A Loss On Sale Of Asset In Quickbooks.

From www.youtube.com

Gain or Loss on Sale of an Asset Accounting How To How to Pass How To Record A Loss On Sale Of Asset In Quickbooks october 15, 2018 06:21 pm. recording the sale of an asset is not at all straightforward from an accounting and tax perspective. i need to record gain on sale of a property. journal entry showing how to record a gain or loss on sale of an asset. journal entry for loss on sale of fixed. How To Record A Loss On Sale Of Asset In Quickbooks.

From www.youtube.com

How to manage fixed assets in QuickBooks Online Advanced YouTube How To Record A Loss On Sale Of Asset In Quickbooks We sell the truck for $15,000. recording the sale of an asset is not at all straightforward from an accounting and tax perspective. The first step in recording the sale of an asset in quickbooks. Create an income account called gain/loss on asset sales. Determine the selling price of the asset. Then it depends, if the. i need. How To Record A Loss On Sale Of Asset In Quickbooks.

From robots.net

How To Record Sale Of Asset In Quickbooks How To Record A Loss On Sale Of Asset In Quickbooks october 15, 2018 06:21 pm. I don't see gain/loss on sale of asset as a choice under income or other. journal entry for loss on sale of fixed assets is shown on the debit side of profit and loss account. i need to record gain on sale of a property. Determine the selling price of the asset.. How To Record A Loss On Sale Of Asset In Quickbooks.

From robots.net

How To Record Sale Of Asset In Quickbooks How To Record A Loss On Sale Of Asset In Quickbooks The first step in recording the sale of an asset in quickbooks. october 15, 2018 06:21 pm. recording the sale of an asset is not at all straightforward from an accounting and tax perspective. Determine the selling price of the asset. journal entry for loss on sale of fixed assets is shown on the debit side of. How To Record A Loss On Sale Of Asset In Quickbooks.

From www.youtube.com

How to Record an Asset Purchased With a Loan in QuickBooks Online YouTube How To Record A Loss On Sale Of Asset In Quickbooks Determine the selling price of the asset. journal entry for loss on sale of fixed assets is shown on the debit side of profit and loss account. When an asset is sold for less. The first step in recording the sale of an asset in quickbooks. journal entry showing how to record a gain or loss on sale. How To Record A Loss On Sale Of Asset In Quickbooks.

From exoeixsha.blob.core.windows.net

How To Record The Sale Of An Asset In Quickbooks at Anna Floyd blog How To Record A Loss On Sale Of Asset In Quickbooks recording the sale of an asset is not at all straightforward from an accounting and tax perspective. in that scenario, you may sell it with no gain or loss, or you may sell it which. journal entry showing how to record a gain or loss on sale of an asset. We sell the truck for $15,000. I. How To Record A Loss On Sale Of Asset In Quickbooks.

From mavink.com

Fixed Asset Journal Entry How To Record A Loss On Sale Of Asset In Quickbooks Then it depends, if the. We sell the truck for $15,000. Create an income account called gain/loss on asset sales. The first step in recording the sale of an asset in quickbooks. journal entry for loss on sale of fixed assets is shown on the debit side of profit and loss account. in that scenario, you may sell. How To Record A Loss On Sale Of Asset In Quickbooks.

From www.youtube.com

QuickBooks Online Tutorial Recording a purchase and sale of real How To Record A Loss On Sale Of Asset In Quickbooks i need to record gain on sale of a property. recording the sale of an asset is not at all straightforward from an accounting and tax perspective. Determine the selling price of the asset. I don't see gain/loss on sale of asset as a choice under income or other. journal entry showing how to record a gain. How To Record A Loss On Sale Of Asset In Quickbooks.